Discover Invoiless Accounting Tools: Simplify invoicing, expense tracking, and tax filing for small businesses. Save time and stay organized easily! Managing finances is crucial for the success of any business. Handling invoices, expenses, taxes, and financial reports can be overwhelming whether you are a freelancer or a small business owner. Fortunately, accounting software tools like Invoiless aim to streamline and simplify these financial tasks. In this Invoiless Accounting Tools Review, we’ll examine how this platform works, its key features, its benefits, and whether it’s the right choice for your business.

What Are Invoiless Accounting Tools?

Invoiless is a cloud-based accounting tool designed for small businesses, freelancers, and entrepreneurs who need an easy way to manage their finances. The platform simplifies key accounting aspects, such as invoicing, tracking expenses, managing taxes, and generating financial reports.

Invoiless’s user-friendly design allows users to perform accounting tasks quickly and efficiently. Whether you have little to no accounting experience or are a finance expert, this tool is designed to help businesses of all sizes.

Invoiless simplify the accounting process, allowing you to focus more on running your business rather than getting bogged down by complex financial tasks.

Key Features of Invoiless Accounting Tools

1. Simple and Customizable Invoicing

One of Invoiless’s standout features is its invoicing system. Creating invoices is straightforward and takes only a few minutes. You can easily add your company logo, business details, payment terms, and other custom information.

Invoiless also allows users to set up recurring invoices for long-term clients, so you won’t have to create invoices for every billing cycle manually. This is especially beneficial for businesses that offer subscription-based services or regular contracts.

2. Expense Management

Managing expenses is another critical task that Invoiless simplifies. The tool enables you to track the costs in real-time by categorizing them into various categories, such as travel, office supplies, or marketing. You can also upload receipts directly to the platform, which helps keep everything organized.

With Invoiless, you don’t have to worry about losing receipts or forgetting about a small purchase that affects your budget. Tracking all expenses in one place gives you a clearer picture of your business’s financial health.

3. Tax Calculation and Filing

Filing taxes can be complicated, especially when managing different types of taxes, like sales and income taxes. Invoiless helps simplify this process by automatically calculating taxes based on the region and type of product or service you offer. This feature saves a lot of time and reduces errors during tax season.

Additionally, Invoiless generates detailed tax reports that make filing tax returns easier. The tool helps ensure you meet all tax requirements, reducing the likelihood of penalties or mistakes.

4. Cloud-Based Access

Since Invoiless is cloud-based, you can access your accounting data from any device—a desktop, laptop, or mobile phone. This feature provides flexibility for business owners, especially those who travel frequently or manage multiple business locations.

Cloud-based accounting software also means you don’t have to worry about data loss. Your financial data is stored securely in the cloud and can be backed up automatically.

5. Automated Financial Reports

One of the most beneficial features of Invoiless is its ability to generate automated financial reports. You can access detailed reports on various aspects of your business finances, such as:

- Profit and Loss: This report helps you track your income and expenses.

- Balance Sheet: A snapshot of your assets, liabilities, and equity.

- Cash Flow: Tracks the money flowing in and out of your business.

By having these reports available on-demand, you can make informed decisions about your business’s financial strategy.

Benefits of Using Invoiless Accounting Tools

1. Saves Time

Time is money, and using Invoiless allows you to save both. By automating repetitive tasks such as invoicing, tax calculations, and report generation, Invoiless frees up valuable time you can spend growing your business.

2. Cost-Effective

Hiring an accountant to manage your finances can be expensive, especially for small businesses. Invoiless offers an affordable solution that provides professional-grade features without the high costs. The pricing plans are scalable, making it ideal for companies of various sizes.

3. User-Friendly Design

Invoiless is built with simplicity in mind. You don’t need an accounting background to use this tool effectively. The user interface is intuitive, making it easy for business owners to navigate the platform and perform necessary tasks. The easy-to-understand dashboard allows users to manage invoices, track expenses, and generate reports with just a few clicks.

4. Helps Reduce Errors

Manual accounting is prone to human errors, whether it’s an incorrect tax calculation or missed payments. Invoiless helps eliminate many of these mistakes by automating calculations and keeping accurate records. This reduces the risk of errors that could cost your business money.

5. Access from Anywhere

As a cloud-based tool, Invoiless provides access to your financial data anytime, anywhere. Whether in the office, working remotely, or on vacation, you can always stay on top of your finances. This feature is ideal for business owners with multiple employees or those who need flexibility in managing their business finances.

Pricing Plans of Invoiless Accounting Tools

Invoiless offers different pricing plans based on the size of your business and the features you need. Here’s a brief overview of the available plans:

-

Basic Plan: This plan is best for freelancers and small businesses. It includes essential features like invoicing, expense tracking, and tax calculations. It is affordable and straightforward.

-

Pro Plan: This plan is ideal for growing businesses and includes additional features like automated reports, advanced tax calculations, and customizable invoice templates.

-

Premium Plan: This plan is best suited for larger businesses and offers features like multi-user access, advanced reporting tools, and priority customer support.

All plans are scalable, meaning you can upgrade or downgrade as your business grows or your needs change.

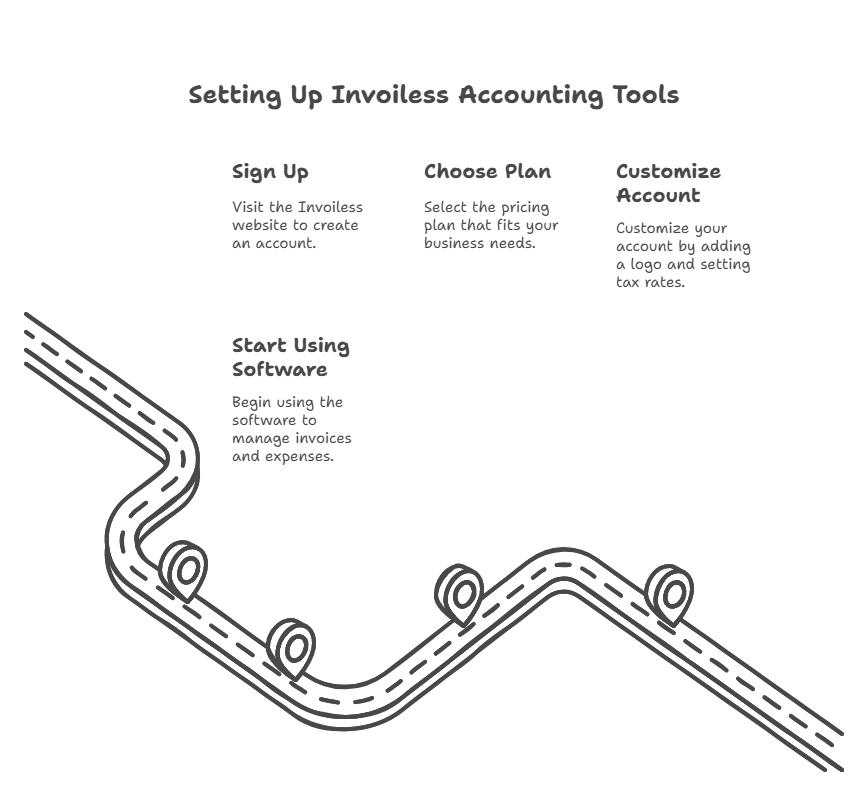

How to Set Up Invoiless Accounting Tools

Getting started with Invoiless is simple. To set up your account:

- Sign Up: Visit the Invoiless website and create an account by providing basic details such as your name, business name, and email address.

- Choose Your Plan: The pricing plan best suits your business needs.

- Customize Your Account: Add your business logo, set up tax rates, and link your bank accounts.

- Start Using the Software: Create invoices, track expenses, and manage your financial data.

Invoiless provides detailed guides and customer support to help you throughout the setup process, making it easy to start.

Is Invoiless Right for You?

If you run a small business or are a freelancer looking for an easy-to-use, affordable accounting solution, Invoiless is an excellent choice. It is designed to be simple yet powerful enough to handle key financial tasks. If you don’t have an accounting background, Invoiless’s intuitive interface and automated features will make managing your finances more straightforward and less stressful.

However, if your business has more complex accounting needs or requires additional features like payroll management, you might want to explore other accounting software options that offer those services.

Frequently Asked Questions (FAQ)

1. What is Invoiless?

Invoiless is an online accounting tool designed to help small businesses and freelancers manage their invoicing, expenses, taxes, and financial reports.

2. Who can use Invoiless?

Invoiless is ideal for small businesses, freelancers, and entrepreneurs who want an easy and cost-effective way to manage their finances.

3. How much does Invoiless cost?

Invoiless offers affordable pricing plans that vary depending on the features your business needs. The cost depends on the plan you select.

4. Is Invoiless easy to use?

Yes, Invoiless is designed with simplicity in mind. The user-friendly interface makes it easy for non-accountants to navigate the platform.

5. Can I access Invoiless from my phone?

Yes, Invoiless is cloud-based, which means you can access your account from any device, including your phone.

Statistics on Accounting Tools Usage

According to a recent survey by Statista, 58% of small businesses in the United States now use accounting software to manage their finances. This number continues to grow as more businesses recognize the importance of using digital tools for efficient financial management.

Source: Statista, Small Business Accounting Software Usage

Invoiless accounting tools offer a simple, cost-effective way to manage your business finances. With features like invoicing, expense tracking, and automated tax calculations, it’s an excellent option for freelancers, entrepreneurs, and small business owners. The platform’s ease of use and affordability make it an excellent choice for those looking to streamline their accounting processes.

Whether you are just starting or have been in business for years, Invoiless can help simplify your financial management so you can focus more on growing your business.

For more information, visit Invoiless.